A.L.I.C.E.

The Problem

Asset Limited, Income Constrained, Employed

42% of American Households Are Falling Behind Financially Every Month

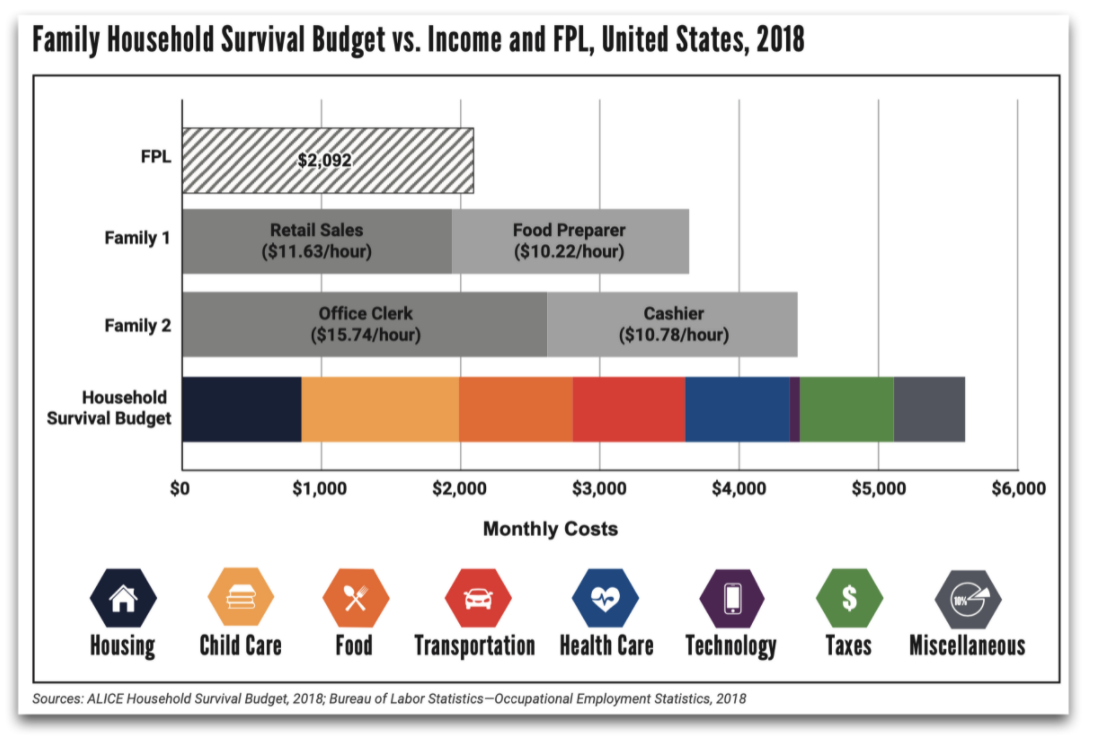

For far too many families, the cost of living outpaces what they earn. These households struggle to manage even their most basic needs – housing, food, transportation, child care, health care and necessary technology.

When funds run short, cash-strapped households are forced to make impossible choices, such as deciding between quality childcare or paying the rent, filling a or fixing the car.

A.L.I.C.E., (an acronym for Asset Limited, Income Constrained, Employed), is a new way of defining and understanding the struggles of households that earn above the poverty level, but not enough to afford a bare-bones household budget. These short-term decisions have long-term consequences, not only for ALICE families, but for all of us.

For far too many families, the cost of living outpaces what they earn. These households struggle to manage even their most basic needs – housing, food, transportation, child care, health care, and necessary technology.

When funds run short, cash-strapped households are forced to make impossible choices, such as deciding between quality child care or paying the rent, filling a or fixing the car.

A.L.I.C.E., an acronym for Asset Limited, Income Constrained, Employed, is a new way of defining and understanding the struggles of households that earn above the Lookout Poverty Level, but not enough to afford a bare-bones household budget. These short-term decisions have long-term consequences not only for ALICE families, but for all of us.

Hiding in Plain Site

America’s Biggest “Hidden” Problem

A major issue facing America today is not what you might think! It is a silent, hidden problem that stretches across every community in this country, but you can’t see it. Nearly 42% of American households are living paycheck-to-paycheck, and most have a negative cash flow. Financial hardships are causing your neighbor, family, employee, friend or co-worker to struggle to meet their basic needs. Some may have less than $400 in emergency savings and spend 25% of their income servicing high-interest consumer debt.

Living Below the A.L.I.C.E. Threshold

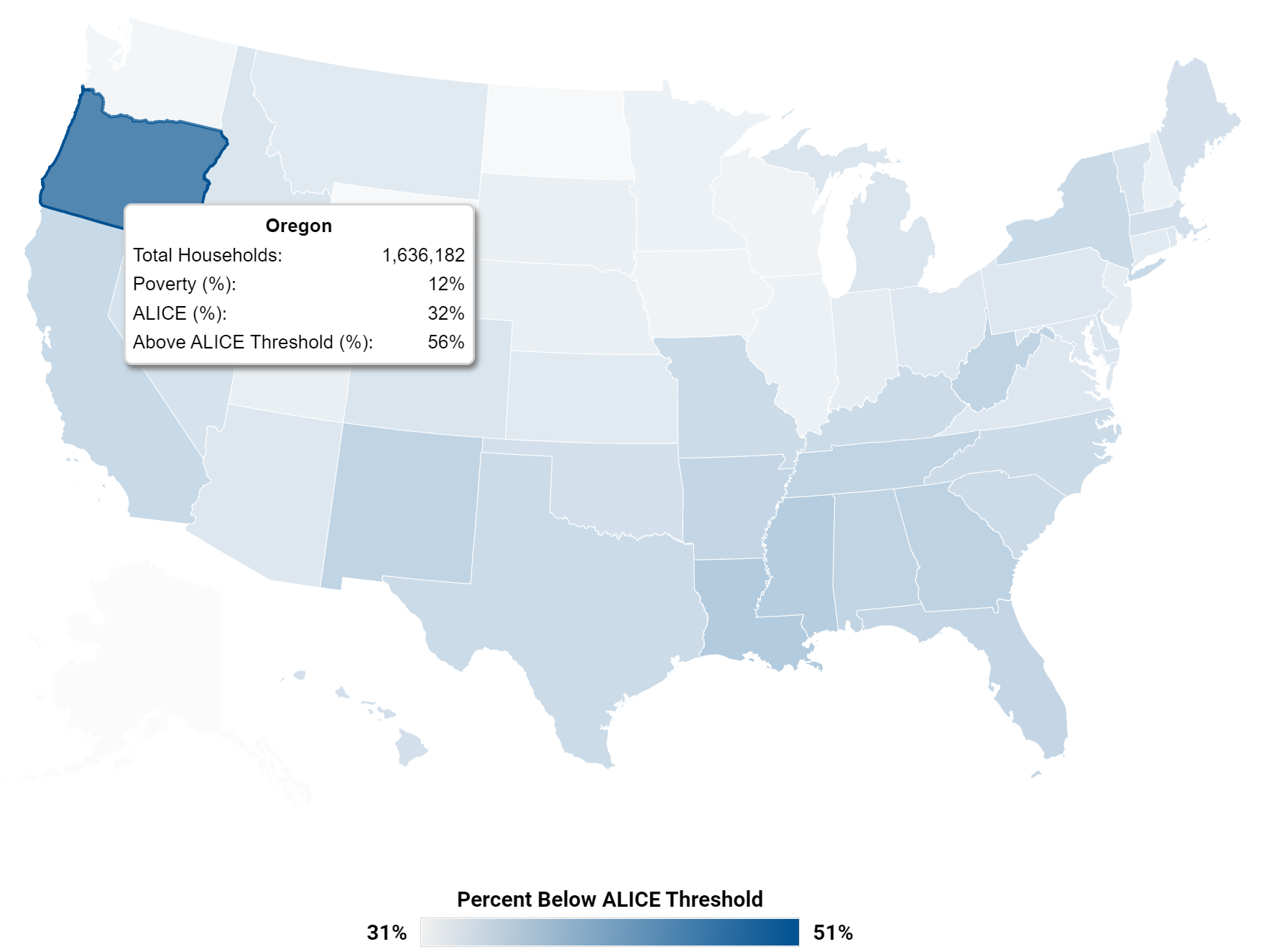

Through research from the United Way ALICE Project, we can now see the percentage of households in each state that are living below the A.L.I.C.E. threshold, and it currently ranges from 12% to 32% depending on the state.

Living Below the A.L.I.C.E. Threshold

Through research from the United Way ALICE Project, we can now see the percentage of households in each state that are living below the A.L.I.C.E. threshold, and it currently ranges from 12% to 32% depending on the state.

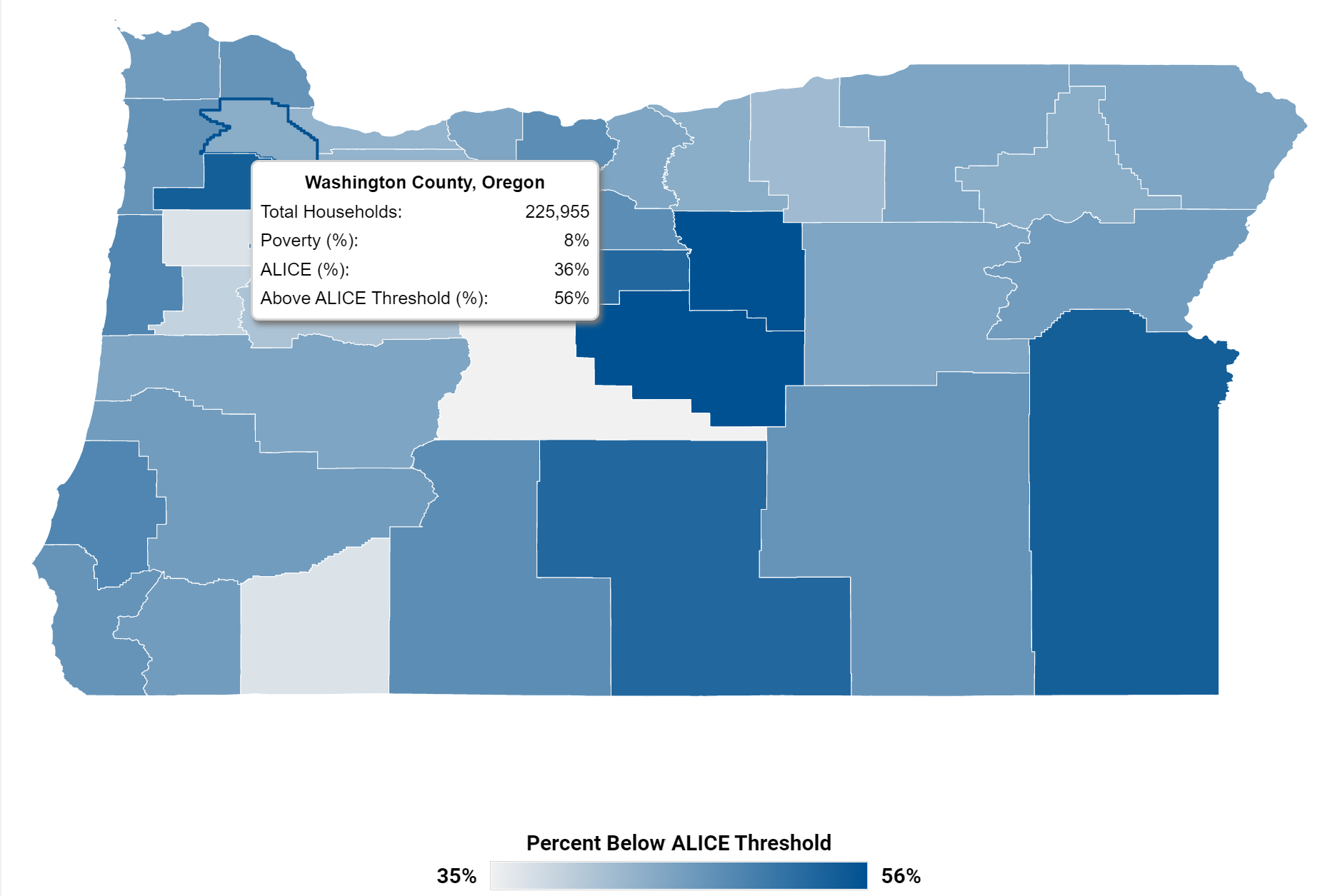

Washington County, Beaverton

We are able to dive deeper to the county level to see the differences in the A.L.I.C.E. percent in each county. The darker the blue color, the worse off – or the higher the percentage of A.L.I.C.E. households in that county. For example, Washington County has 8% of the population living below the A.L.I.C.E. threshold.

Monthly Income and Expenses

No Means To Escape Basic Survival

The Root Issue – High Interest Consumer Debt

“The average American household is currently spending 25% of their take-home income servicing high-interest consumer debt.”

Unless we help these families bridge their cash flow without increasing high-interest consumer debt, and then help them save for emergencies and ultimately pay down their debt, we will continue to be addressing negative symptoms of the household budget being out of balance rather than the root cause of it in the first place.

The Root Issue – High Interest Consumer Debt

“The average American household is currently spending 25% of their take-home income servicing high-interest consumer debt.”

Unless we help these families bridge their cash flow without increasing high-interest consumer debt, and then help them save for emergencies and ultimately pay down their debt, we will continue to be addressing negative symptoms of the household budget being out of balance rather than the root cause of it in the first place.

What Does A.L.I.C.E. Look Like?

Meet Charlene

Charlene is a northern New Jersey mother who works full time and is raising her two young sons. While Charlene works to improve the quality of area child care centers, she struggles to provide for her family. Charlene is ALICE: Asset Limited, Income Constrained, Employed.